How to start with investing as a beginner?

Your 20s are the best time to start investing. 🎉 Maybe you think you don’t have enough money and investing is reserved for wealthy people but that’s not true! 🙀 In fact, if you don’t have much money, you have little to lose! 😜

Something magical happens when you invest: it’s the compound interest. 🤑

If you invest 1 000€ at 20 years old with an interest of 7%, you will have 15 000€ at 60 years old. 💰

If you invest 10 000€ at 55 years with an interest of 7%, you will only have 14 000€ at 60 years old. 💵

Do you see the difference? 😆

Imagine now you invest 1 000€ at 20 years old and after that, you only invest 10€ per month for 40 years, always with the interest of 7%, then you will have almost 39 000€ at 60 years old (you will only invest 5 800€ and you win 33 000€ with interest compound). 😻

Go check by yourself: Compound interest calculator 📲

So the success of compound interest is to begin early and let your money work for you. 🎉 The longer you leave your money invested, the greater the effect of compound interest. 🙌

Another advantage of investing for the long term in the stock market is if the stock market flops, your investments have time to go up again. 🎢 As you may know, the market stock works like a yo-yo. The prices go up and down all the time, this is called volatility. However, historically, in the long term, the curves are rising. 📈

Finally, if you think that investing 1 000€ isn’t possible for you, it’s not a problem if you invest less. 💪 Having more capital doesn’t make you a better investor. If you can’t grow a portfolio of 100€ or 500€, you won’t be able to grow a capital of 1 000 000€. 😏

So even if you invest only 100€ or 500€, you will still learn how to manage your capital without ruining your assets. 🤓

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.” – Warren Buffet. 🚀

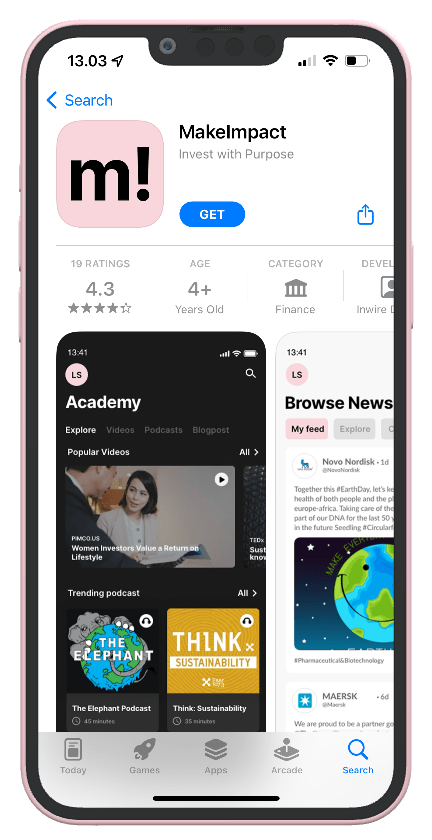

The most important thing is to start investing and to be patient and consistent. 💵 This is your time, join us now and be the movement and make!mpact! ❤️

Disclaimer:

We are not financial advisors, and we do not claim any responsibility for the financial choices you may make on the basis of what you read in this blog. The content of the blog is of an informative nature and has an educational purpose. It is not to be regarded as either investment advice or recommendations, nor do we relate to the reader’s private, financial situation. Any use of information is at your own risk. We encourage you to seek financial guidance if you do not understand the risks in the area. We are not responsible for any choices you may make, based on what you read on the m!Club or from our company page on LinkedIn — MakeImpact.