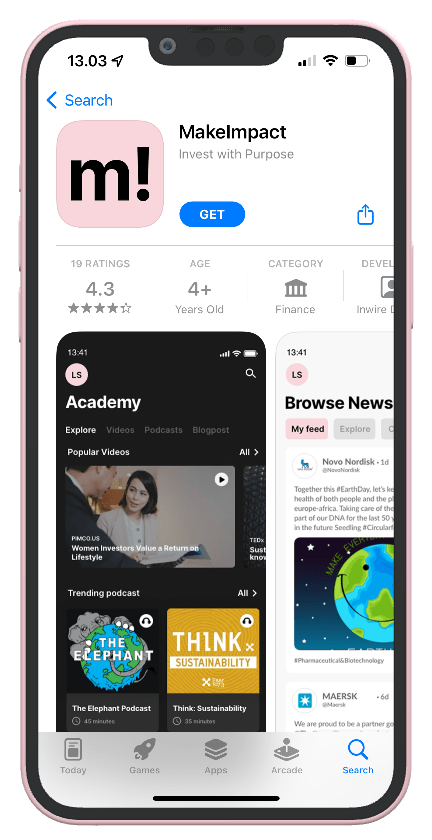

5 do’s and dont’s in impact investing

A big part of impact investing is, of course, understanding how to invest and finding the right company to invest in. 💼 That’s why, today, we’re introducing you to a few do’s and don’ts in investing that might help you find those investments that both yield a return and match your values!

✔️ DO understand what you invest in and do it long-term!

Knowledge is power! 🧠⚡️ Just because you’ve heard about an up-and-coming business in an article or from a friend does not mean that you should start investing in said business. Always make sure to do your own research beforehand.

One key element is understanding where the business makes the most money. 💰 For example, do you know Amazon’s main revenue driver? You should also think about the company’s future! A company may look interesting now, but will it still make profits in 10 years? ⏳ Once you feel confident that a stock is both likely to increase in value and also matches your beliefs, feel free to invest away.

🙅♀️ DON’T let your emotions interfere!

Investing should be done on a rational basis. As people, we’re emotionally driven, ❤️ and while emotions help us make decisions, they should not play a part in deciding to invest in a company or not. You may be extremely excited about a company, but if it has bad financials, it may face bankruptcy.

One good example is FOMO (= in the sense of investing). 🤑 Many investors tend to sell their stocks as soon as they have made a good return, but, it would probably be more profitable for them to hold on to such good investments even longer!

FOMO works the other way around, too: Many investors tend to hold on to their bad investments forever instead of selling as soon as their performance deteriorates. 📉 Investing in better stocks would then be an option instead.

✔️ DO make sure your portfolio is diversified!

Many investors choose to diversify their portfolios since it allows them to minimize the company-specific risk and therefore the overall risk of their portfolio. 💼 However, you should not think that simply by buying different assets classes, you will be making your portfolio bulletproof against any downturns.

Holding different stocks may protect you from one company’s stock decreasing but not if the whole stock market decreases. Bonds, for example, are a good diversifier if the interest rates go up (bonds value increase, stocks decrease) – but what if there’s a financial crisis? 🤯 You can add many more asset classes such as real estate, art, crypto assets, and many more. 🖼 The risk of a decrease in value of your portfolio will thus minimize (but never be at zero!).

🙅♂️ DON’T attempt to time the market!

It sounds like the easiest play: When the stock prices within a certain sector or even for the market in its entirety are low, and you have a good gut feeling about future prospects of a company, you want to buy its stock now before the price increases. Meaning you’ll make a big profit. 💸😇

Yet, you might want to take another moment to think it over! ✋ Market trends can be extremely hard to predict and depend on numerous factors such as the emergence of a new technology, a change in the regulatory environment amongst other policy changes. 📝

To make things even more complicated, there are unprecedented events that are impossible to forecast. For example, think of Christiano Ronaldo moving his coke bottle out of the picture during a press meeting at the 2020 Euro Football Championships ⚽️ – the market value of the Coca-Cola stock decreased by $4 billion!

Historically, the market is likely to increase over time – it’s just a matter of time. ⏰ Up until now, every market index has recovered from its many falls. So make sure to stick to your financial goals! Impact investing is a long-term strategy rather than short-term trading, and that’s why attempting to time the market might be hurtful. 💔

🙅♀️ DON’T excessively check your investments!

Imagine you’ve just bought a new stock from a business you’ve been excited about for a while and finally made a decision to invest in – it’s tempting to check in every couple of minutes to see how it’s doing. 👀 Don’t drive yourself crazy and start doubting if the stocks decrease a bit after you bought it, though! You are investing with long-term goals, and your investments are likely to increase in the long run. It’s all about patience! ✌️ Whereas the market might fluctuate, you will see the growth of your investment in the long run.

All in all …

Be aware of your own biases, try to follow some of the above advice, and allow yourself to trust in your own analysis and research – that already makes you a better investor! 🤲🌍 So what are you waiting for? Go find some investments that make an impact on the world and apply them to your financial goals.

Be the movement – make!mpact 💞

Disclaimer:

We are not financial advisors, and we do not claim any responsibility for the financial choices you may make on the basis of what you read in this blog. The content of the blog is of an informative nature and has an educational purpose. It is not to be regarded as either investment advice or recommendations, nor do we relate to the reader’s private, financial situation. Any use of information is at your own risk. We encourage you to seek financial guidance if you do not understand the risks in the area. We are not responsible for any choices you may make, based on what you read on the m!Club or from our company page on LinkedIn — MakeImpact.