What do we mean with the terms sustainable investing, thematic investing, and impact investing? 💚

As a first-time investor, you’ve most likely come across the terms sustainable investing, thematic investing, and impact investing. 💬 If these words all seem foreign and mysterious to you, don’t worry – we’re here to help you untangle the mess!

Generally speaking, sustainable finance is an umbrella term that encompasses the three investment methods mentioned above. ☂️🤲 As you begin investing and start building your own portfolio, you may choose one of these methods, or a combination of them, if you aim to incorporate sustainability in your portfolio. ♻️ They all represent different investment strategies, so, without further ado, let’s get into it!

Sustainable investing …

is when you explicitly incorporate sustainability measures and metrics (such as ESG criteria) into your search for stocks to invest in. There are two different ways to do so: 1️⃣ integration and 2️⃣ screening.

Integration put simply, is when you take a specific ESG metric, such as carbon emissions 🏭💨 and try to estimate future impacts in your analysis. The world is moving towards reaching a ‘net zero’ and almost every country and company plan to reduce most of their carbon emissions. 😷

One consequence is that companies emitting large amounts of CO2 through their production of goods are likely to be affected by a higher carbon price since companies need to buy CO2 certificates to offset their pollution. 🌲🌳

If companies continue to emit constant CO2 amounts in spite of higher offsetting prices, the cost of offsetting is bound to increase, which will lead to decreasing profits. The company value would depreciate, leading to a lower share price. 📉 All in all, implementing such metrics into your analysis can help you better assess risks and, ultimately, increase your return on investments. 👏

Another way to approach sustainable finance is to do a screening, where one applies filters to create a ‘basket’ of stocks or a specific stock index. These filters are based on your investment preferences, values, and ethics. ⚖️ 🌎

There are different methods of filtering:

👉 Negative screening is used to exclude ‘bad’ stocks, also called sin stocks, from your further analysis. It should be noted, however, that negative screening can hinder your performance and reduce diversification.

👉 With positive screening (also referred to as best-in-class screening 🌟), you simply select a sustainability metric and benchmark all companies in a sector. You then proceed with your analysis using only the companies that perform best according to your metric.

👉 Norms-based screening is used to exclude anything that does not meet certain minimum standards such as ‘ILO’, ‘the OECD Guidelines for Multinational Enterprises’ or the ‘UN Global Compact’.

We hope you now have a clearer picture of what sustainable investing is. 💰🌱 So let’s jump into the next investment method.

Thematic investing …

is another way to buy shares or other investments that benefit from a certain trend. This trend does not necessarily have to be related to sustainability or social issues. 🤷♀️ It can range from hydrogen and electric cars to remote working and meat alternatives. It may also involve higher risk, as investments are concentrated in one industry or sector, potentially leading to increased volatility.

Impact investing …

is a term that first appeared in 2007. It should be noted that impact investing is not a protected term and different definitions exist. One of the most widely recognized definitions is that of the Global Impact Investing Network (GIIN). 📖 It defines impact investing as investments specifically aimed to address social or environmental challenges (e.g. education, clean energy, and healthcare). 💓 It can therefore be seen as a subset of thematic investing. Furthermore, impact investing particularly draws upon the concept of the measurability and quantification of impact.

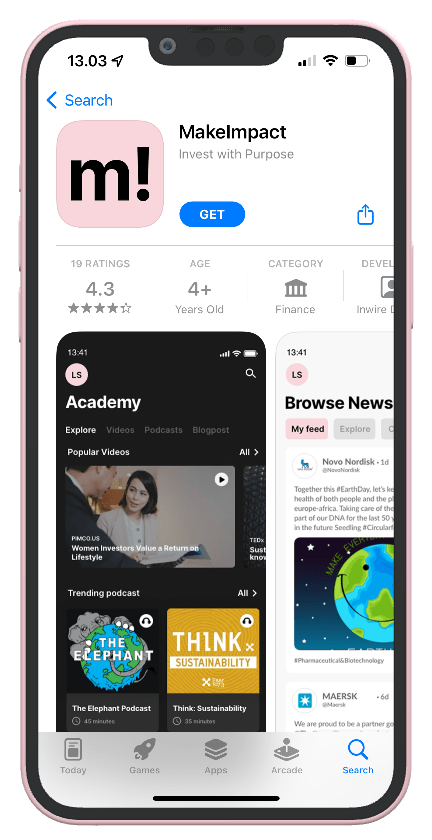

Whew, that was a lot of information! 😅 Hopefully we helped you untangle any messy definitions, and you can now distinguish between the different methods. 🤓 So, let’s start making our portfolios sustainable! Join the movement – make an impact!

Disclaimer:

We are not financial advisors, and we do not claim any responsibility for the financial choices you may make on the basis of what you read in this blog. The content of the blog is of an informative nature and has an educational purpose. It is not to be regarded as either investment advice or recommendations, nor do we relate to the reader’s private, financial situation. Any use of information is at your own risk. We encourage you to seek financial guidance if you do not understand the risks in the area. We are not responsible for any choices you may make, based on what you read on the m!Club or from our company page on LinkedIn — MakeImpact.